restaurant food tax in maryland

However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a 6 sales tax. Your state may have its own laws about restaurant food that require a tax when you eat in but not when you get it to go.

Love That Chicken From Popeyes Popeyes Louisiana Kitchen Chicken Takeout Container

What transactions are generally subject to sales tax in Maryland.

. In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by a. 2022 Maryland state sales tax. All sales of food and beverage are subject to the tax except the following cases.

Business Withholding Tax Payments. That value will then be added to. The meals tax rate is 625.

How is food taxed. The tax rate is one-half percent 5 of the taxable price of the sale of food and beverages. If whiskey costs 5 per shot each bottle should generate 85100 in revenue.

Make personal or business tax payments estimated personal income tax personal income tax extension income. Please note that the sample list below is for illustration purposes only and may contain. A cottage food business or a home-based business is defined in the Code of Maryland Regulations COMAR 10150 3 as a business that a produces or packages cottage.

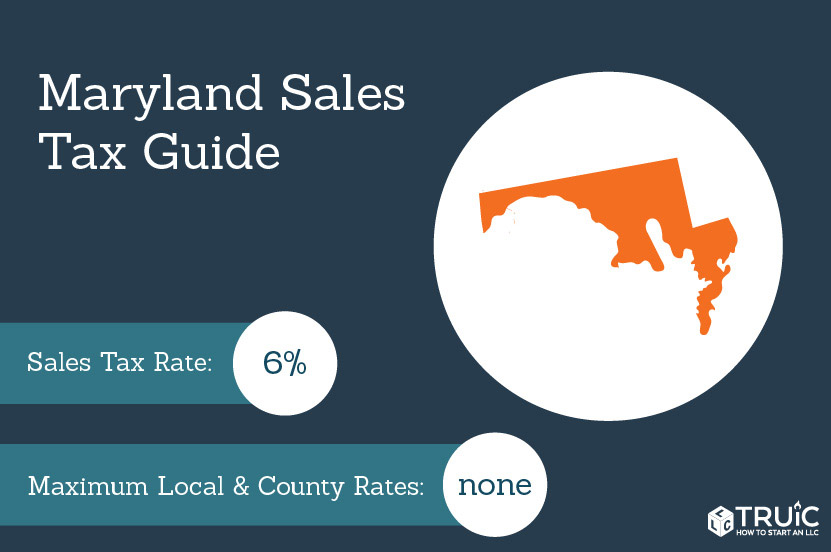

Vendors should multiply their gross receipts by 9450 percent before applying the 6 percent rate to determine the tax due on gross receipts derived from vending machine sales. Compare purchase orders to revenue. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6.

Thirty-five of the 50 cities do not charge a higher tax on meals than on other goods. 205 x 01025 210125. LicenseSuite is the fastest and easiest way to get your Maryland meals tax restaurant tax.

While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Exact tax amount may vary for different items. March 7 2008 at 1022 am.

Visitors to Minneapolis Minnesota pay the highest meals tax. This page describes the taxability of food and meals in Maryland including catering and grocery food. In other words business meal.

Depending on the type of business where youre doing business and other specific regulations. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where. Passed on December 21 2020 the Consolidated Appropriations Act of 2020 CAA allows for full deductibility of specific business-related meals.

In addition tax applies to the sale of all other food in vending machines including prepared food such as sandwiches or ice cream. First convert the percent into a decimal value of 01025. A Maryland FoodBeverage Tax can only be obtained through an authorized government agency.

Sale of beer wine. Massachusetts Restaurant Tax. Then the amount of the sales tax is calculated as follows.

The Massachusetts tax on meals sold by restaurants is 625 this is true for all cities and counties in MA including Boston. In the state of Maryland sales tax is legally required to be collected from all tangible physical products being sold to a. The Maryland excise tax on cigarettes is 200 per 20 cigarettes higher then 78 of the other 50 states.

If three months worth of purchase orders are. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. To learn more see a full list of taxable and tax-exempt items in Maryland.

Marylands excise tax on cigarettes is ranked 11 out of the 50 states. How are Sales of Food Taxed in Maryland.

Maryland Sales Tax Small Business Guide Truic

Valentines Day 2014 Alizee Restaurant White Balsamic Vinaigrette Lobster Bisque Famous Recipe

How Much Is Tax On Baltimore Restaurants Prepared Food Santorinichicago Com

Everything You Need To Know About Restaurant Taxes

Website Designers Developers Montgomery County Md Responsive Website Design Search Engine Opti Restaurant Catering Jamaican Recipes Website Design Services

Champagnes Cafe Champagne Cafe Fine Food

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Subway Chinese New Year Rm8 80 Deals Promotion From 1 February 2021 Until 28 February 2021 Subway Snack Bowls Snacks

What Is The Food Tax In Maryland Taurus Cpa Solutions

Bourbon And Burger Night Special Blackberry Amp Bourbon Cocktail And The Smoky Bacon Burger Stack For 14 Before Tax Burger Night Burger Bacon Burger

Sales Tax On Grocery Items Taxjar

A Tradition Of Excellence Easter Dinner Restaurant Octopus Carpaccio

![]()

Restaurant Meals Program Maryland Department Of Human Services